Diversify to Thrive: A Path to Financial Success!

At its core, diversification is a risk management strategy that involves spreading your investments across various assets.

Are you tired of watching your investments fluctuate like a roller coaster? Do you want to protect your hard-earned money while maximizing returns? If so, it’s time to dive into the world of diversification!

Understanding Diversification

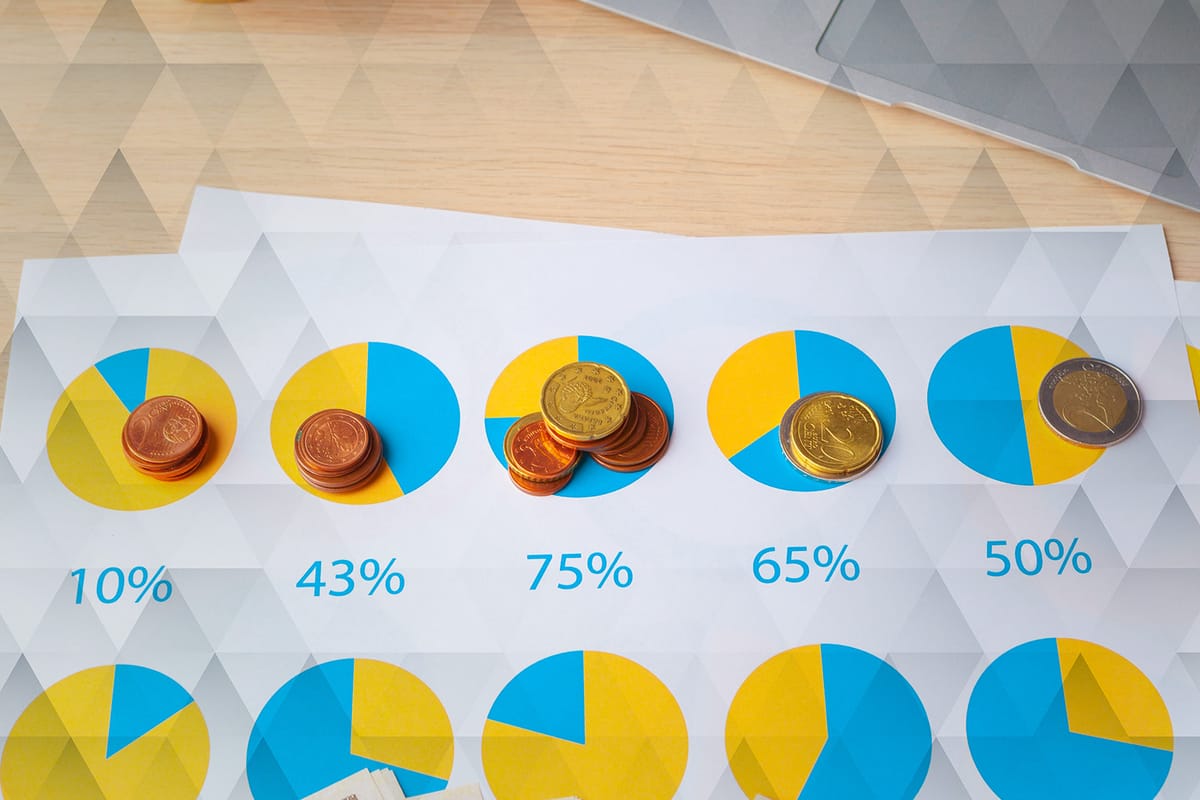

At its core, diversification is a risk management strategy that involves spreading your investments across various assets. The idea is simple: don’t put all your eggs in one basket! By investing in different asset classes, sectors, or geographic regions, you can minimize the impact of a poor-performing investment on your overall portfolio.

Why is Diversification Important?

Reduces Risk: By diversifying, you reduce the risk of a single investment significantly affecting your overall portfolio. If one investment falters, others can help cushion the blow.

Enhances Returns: A well-diversified portfolio can improve your chances of achieving better returns. Different asset classes often perform differently under various market conditions, which can help you capitalize on growth opportunities.

Smoother Ride: Diversification can lead to a more stable portfolio, providing you with peace of mind during market volatility.

How to Diversify Your Investments

Invest in Different Asset Classes: Consider a mix of stocks, bonds, and other fund types. Each asset class reacts differently to market changes, offering a buffer against volatility.

Choose Various Sectors: Don’t just invest in tech stocks; include healthcare, energy, consumer goods, and more. This way, you're not overly exposed to one industry’s performance.

Consider International Investments: Global markets can provide growth opportunities that aren’t tied to your home country’s economy. Investing in international funds can help you tap into these markets.

Get Started Today!

Ready to take charge of your financial future? Diversification is just the beginning! Start investing in funds through Seedbox.ph, GFunds, or Maya Funds for a hassle-free experience or you can explore the dynamic world of stocks through our SBX app.

You can download the SBX app for free through Google Play and App Store to start investing in the stock market.