Unlocking Success: How Clear Investment Goals Can Help You Thrive Financially

Setting specific goals is the first step toward not only succeeding but thriving in investment planning.

When Filipinos think of investing, they often focus on ways to grow their money—whether through the stock market, mutual funds, or real estate. But truly thriving in your investment journey requires more than just aiming for profits; it’s about investing with purpose. Without specific goals, investing can feel like traveling without a destination—you’re moving, but there’s no guarantee you’ll reach a place of real fulfillment.

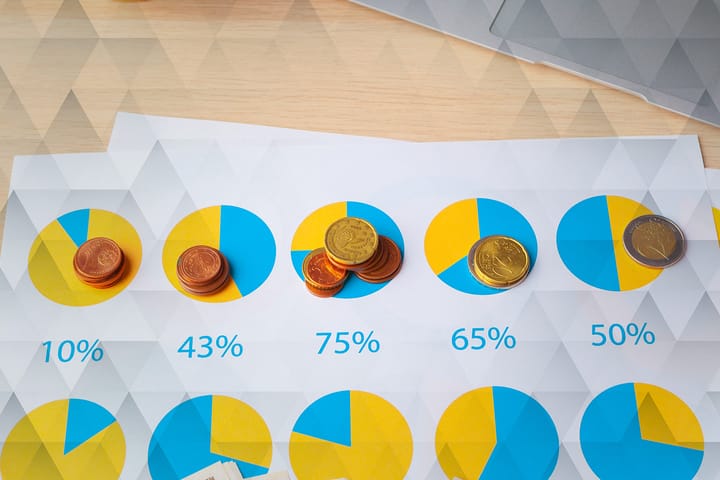

Why Specific Goals Matter to Your Investment Journey

Setting specific goals is the first step toward not only succeeding but thriving in investment planning. Your reasons for investing might range from buying a house in Metro Manila, saving for your child’s college education, or retiring comfortably in your province. Each goal requires a unique strategy, timeline, and target amount, helping you build a path that’s clear and attainable.

With specific goals, you can determine:

- How much you need (e.g., PHP 5 million for a home, or PHP 1 million for your child’s college tuition).

- By when you need it (e.g., five or 20 years).

- What type of investments can get you there (e.g., mutual funds, stocks, bonds, etc.).

Clear goals keep you focused and allow you to make decisions aligned with your desired outcomes. Vague goals, on the other hand, can lead to impulsive moves and financial uncertainty, while specific goals provide direction and purpose.

Specific Goals vs. Vague Goals

Consider two examples:

- “I want to save for my child’s future.”

- “I want to save PHP 1 million for my child’s college education by 2035.”

The first goal lacks specifics, making it hard to build a focused plan. The second goal is clear and measurable, providing a roadmap that helps you allocate funds strategically and gives a sense of control and purpose.

With a clear goal, you can plan your monthly or yearly investments accordingly. For example, if you aim to save PHP 1 million in 15 years, you can calculate monthly contributions and select investments aligned with your timeline and risk tolerance, putting you on a path to thrive financially.

How Clarity Shapes Your Financial Behavior

Clear, specific goals do more than give direction; they drive consistent behavior, which is essential for thriving financially. When you know what you’re working toward, you’re more likely to stay disciplined and avoid impulsive decisions that can derail your progress.

- Encourages Consistency and Discipline

Imagine you’ve set a goal to save PHP 5 million for retirement by age 60. This goal encourages you to stick to a regular savings plan and make consistent contributions to your investments. Whether adding to equity funds, bonds, or a diversified portfolio, your clear objective supports staying on track, even when distractions arise. Behavioral finance highlights that people often struggle with present bias—prioritizing immediate desires over long-term goals. For example, you may be tempted to use extra income on a trip to Boracay instead of adding to your retirement fund. But with a clear goal like PHP 5 million, it’s easier to see the bigger picture and stay motivated. - Prevents Emotional Decision-Making

The Philippine stock market, like any other, has its ups and downs. During downturns, it’s easy to let emotions take over and sell investments, potentially locking in losses. With clear goals, you’re better equipped to stay focused on your long-term plans. When you know you’re investing for a future milestone—like a home purchase or retirement—you’re less likely to make reactive decisions and more likely to ride out temporary market fluctuations. - Adjusts Behavior Based on Time Horizon

Clarity helps you adapt your approach as time goes on. For instance, if you’re 30 and saving for retirement, you have time to take calculated risks with high-growth investments, knowing you can recover from short-term losses. As you get closer to retirement, your strategy can shift to more conservative, lower-risk investments like bonds or money market funds.

The Psychological Benefits of Clear Goals

Clear goals provide more than financial guidance—they also boost motivation. Achieving small milestones, like reaching PHP 100,000 or PHP 500,000 in investments, reinforces your progress and builds confidence. This sense of accomplishment keeps you energized and focused on thriving in the long run.

For example, aiming to save PHP 500,000 for a home down payment might feel overwhelming, but breaking it down to PHP 100,000 annually makes it achievable. Studies show that people are more likely to stick with long-term plans when they can see progress. Clear goals allow you to set manageable milestones, keeping you motivated to thrive.

Conclusion: Clear Goals Lead to Thriving Financial Outcomes

Successful investing isn’t just about picking the right assets; it’s about setting clear, specific goals and making disciplined choices aligned with those goals. With clear objectives, you’re better able to avoid impulsive decisions, stay focused, and navigate market ups and downs.

Whether your dream is to buy a home, fund your child’s education, or retire comfortably, clarity is the foundation of a thriving financial future. Take time to define your goals—the clearer they are, the better your chances of success.

To help achieve these goals, you can consider investing in Unit Investment Trust Funds (UITFs) available in GFunds in Gcash and Maya Funds in Maya. For long-term objectives, you can take a look at equity & feeder funds, both of which offer high growth potential. On the other hand, money market funds are great for short-term goals.

Consider setting specific goals and choosing funds that align with them, so you can watch your investments thrive over time. Whether you're building wealth for the future or securing funds for immediate needs, there’s an investment option designed to help you flourish at every stage. The right choice today can be the first step toward a financially thriving tomorrow.